Current Assets Formula: How to Calculate With Examples

Content

You should categorize these costs as prepaid expenses on the current assets section of your balance sheet. There may be a subtotal on the balance sheet for all current assets.

- Here is a 4-step plan for how to calculate the break even point for your business.

- These include accounts payable, rent, payroll expenses, and more.

- If your enterprise is lacking correct financial risk analysis information, completing a balance sheet can be a great idea.

- They compare them against similar companies in the same industry.

- You can also add in multiple years; if you do, remember to divide the total of all assets by the number of years you’re including.

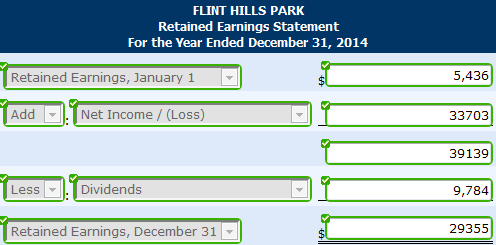

However, it would make sense to obtain the previous year’s Balance Sheet to compare any trends that should be addressed in the next fiscal year. It would also be helpful to read the Notes to Consolidated Financial Statements included in the 10-Ks supplied to the U.S.

What Are 3 Types of Current Assets?

The best way to evaluate current assets is by comparing the number to current liabilities. In the example above of the total current assets formula, ABC Business has significantly more current assets than current liabilities, which is a positive sign.

What is the formula of current assets and current liabilities?

Current ratio (Current Assets / Current Liabilities) Quick ratio = [(Current Assets – Inventory + Prepaid Expenses) / Current Liabilities] Net working capital = (Current Assets – Current Liabilities)

In basic accounting, total assets are also equal to total liabilities and total stockholder’s equity. The total value of assets is based on the purchase price and not on appraised or market value. In the balance sheet, they are also arranged in order of liquidity, or ease of conversion to cash. The current assets formula, sometimes called the total current assets formula, is a key indicator of your business’s short-term financial health.

Small Business 101: How to Calculate Total Current Assets

Cost of debt analysis before taking on a loan, to determine how much the debt will cost and whether you’ll be able to utilize the debt to grow your business. It How to Find Total Current Assets is no secret that customer reviews are one of the most valuable assets in any company. However, many businesses don’t take enough time to manage them properly.

Current assets are usually listed on the company’s balance sheet in descending order of liquidity. Cash is the easiest type of asset to use to fund obligations, so it’s listed first.

Current Assets Formula Example

But if your asset position isn’t as strong, even small variations in revenue can disrupt your business. The total amount of these assets adds up to $6,500 which is then entered under the “current asset” section https://business-accounting.net/ on your balance sheet. For example, say you need to calculate current liabilities for September. To do this, include your mortgage payment for September and any other money owing for that month only.

- Expenses are continuing payments for services or things of no financial value.

- Calculating the current ratio also allows for easy comparison over time.

- If you’re just starting out, you can estimate this and come back later and change it accordingly.

- A balance sheet is a statements that calculates financial aspects of an organization, including the assets, liabilities and equity.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Gives business owners an idea of the average assets they have on hand during a typical one-year period. This can help entrepreneurs plan for the coming year and assess whether they have sufficient assets to reach sales goals. Marketable securities are financial instruments that can be easily converted to cash, such as certain stocks, government bonds, treasury bills, and certificates of deposit. To be considered a marketable security, you must able to cash in the security on a stock exchange or bond exchange and get the face value within a year of purchase. Sometimes, in addition to inventory, there’s a separate line item on the balance sheet for supplies. This line is for raw materials or other items that you need to make your product or run your business.

The depreciation of an asset, from a vehicle to a building, is also considered a fixed cost. Through our software, you can dispatch techs, schedule appointments, create estimates and invoices, take payments, manage reviews and so much more – all on one platform.